For 2023, the AMT exemption amount is USD 126,500 for joint filers (half of this amount for married taxpayers filing a separate return), and USD 81,300 for all other taxpayers other than estates and trusts. For tax year 2023, the 28% tax rate applies to taxpayers with taxable incomes above USD 220,700 (USD 110,350 for married individuals filing separately).įor 2022, the AMT exemption amount is USD 118,100 for married taxpayers filing a joint return (half this amount for married taxpayers filing a separate return) and USD 75,900 for all other taxpayers (other than estates and trusts), and the phase-out thresholds are USD 1,079,800 for married taxpayers filing a joint return and USD 539,900 for all other taxpayers (other than estates and trusts). For tax year 2022, the 28% tax rate applies to taxpayers with taxable incomes above USD 206,100 (USD 103,050 for married individuals filing separately).

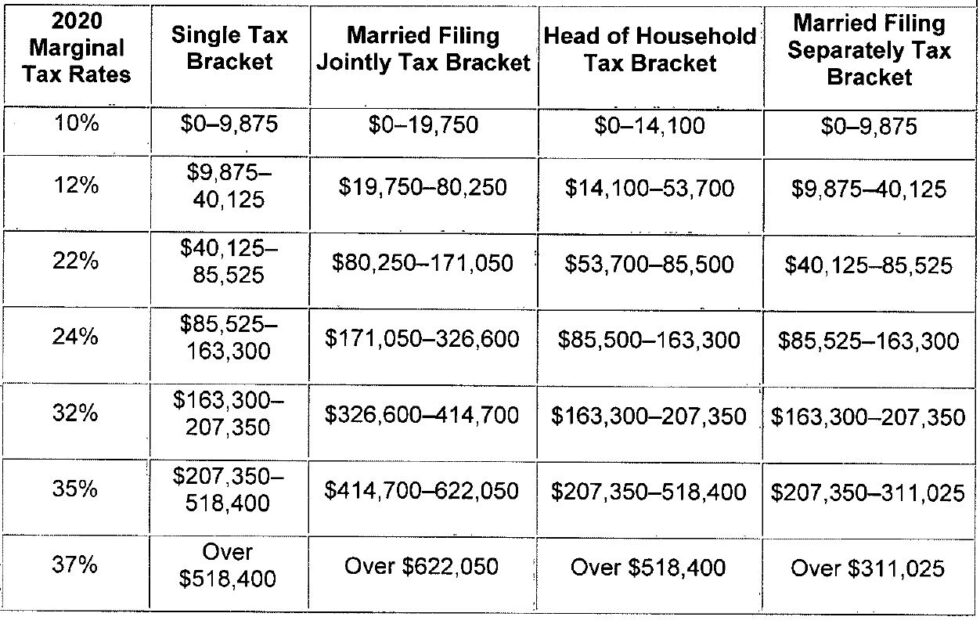

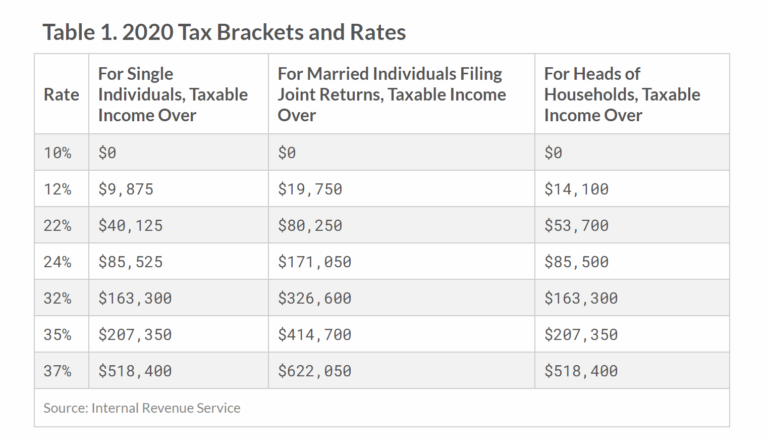

In lieu of the tax computed using the above rates, the individual AMT may be imposed under a two-tier rate structure of 26% and 28%. Non-resident aliens may not take advantage of head of household status or joint return rates.The graduated rates of tax apply to capital gains from assets held for 12 months or less. The maximum federal tax rate on capital gains is 20% for assets held for more than 12 months.

0 kommentar(er)

0 kommentar(er)